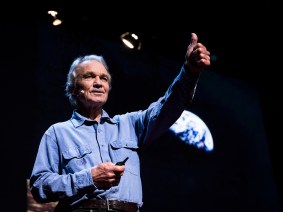

In a mesmerizing display of lyrical prowess, Ian McCallum took center stage at TEDWomen 2016, captivating the audience with his profound insights on conservation through poetry. With a Zulu heritage coursing through his veins and an enchanting Hinglish (Hindi-English) accent that added an irresistible charm to his words, McCallum effortlessly transported us into the heart of nature.

A Melodic Ode to Mother Earth

With eloquence dripping from every syllable he uttered, McCallum painted vivid landscapes with his verses. His poetic symphony celebrated the delicate balance between humanity and the natural world, urging us to recognize our interconnectedness with all living beings. Through metaphors woven intricately like threads in a tapestry, he reminded us that we are not mere spectators but active participants in this grand orchestration.

The Rhythm of Conservation

McCallum skillfully wove together tales of ancient wisdom passed down through generations alongside contemporary challenges faced by our planet. He emphasized how poetry can serve as a powerful tool for raising awareness about environmental issues and inspiring action. Each word resonated like a drumbeat echoing across vast savannas or crashing waves against rugged shores – awakening dormant passions within each listener.

A Call to Preserve Nature’s Verses

As McCallum reached the crescendo of his discourse, he implored us to become custodians of nature’s verses – guardians entrusted with preserving its delicate harmony. Drawing upon his Zulu background and Hinglish accent, he urged us to embrace regional jargon vocabulary as part of our collective lexicon when discussing conservation efforts. By doing so, we can bridge cultural divides and foster a deeper understanding of the interconnectedness between language, culture, and nature.

A Harmonious Finale

McCallum’s enchanting performance left an indelible mark on our hearts. His words echoed long after he stepped off the stage, reminding us that poetry has the power to ignite change and preserve the symphony of life. Let us heed his call to action and embark on a journey where every word becomes a brushstroke painting vibrant strokes of conservation across our shared canvas.